Personal finance refers to the financial management of an individual’s or household’s financial resources, investments, and expenditure. It involves creating a budget, saving and investing, managing debt, and planning for the future. Effective personal finance is crucial for achieving financial stability, security, and independence. In this article, we will discuss the key aspects of personal finance, its importance, and provide tips on how to manage your finances effectively.

Understanding Personal Finance

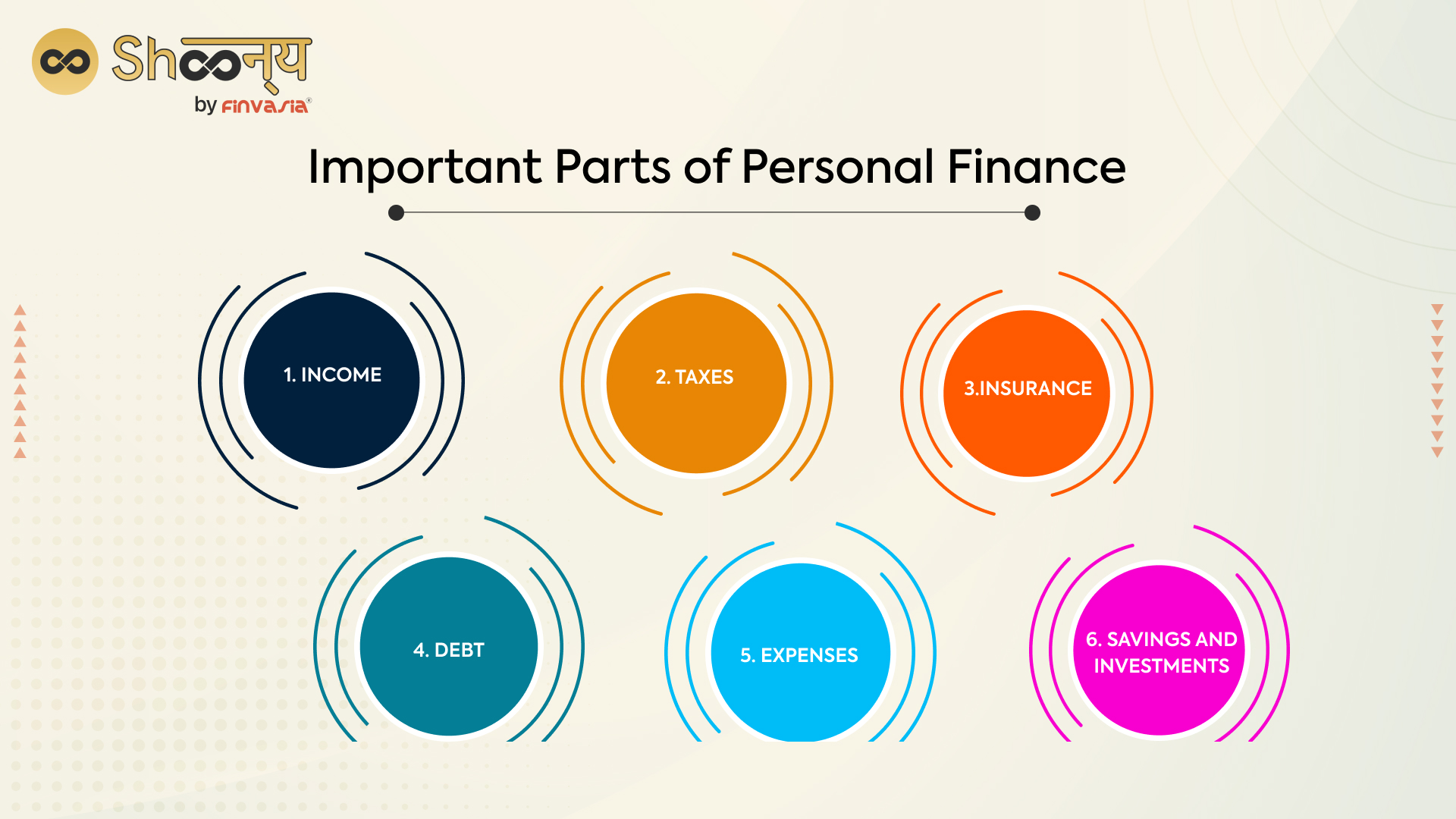

Personal finance encompasses various aspects of an individual’s financial life, including:

- Budgeting: Creating a budget is the first step towards managing your finances effectively. It involves tracking your income and expenses, identifying areas where you can cut back, and allocating funds towards savings and investments.

- Saving: Saving is essential for building wealth and achieving long-term financial goals. It involves setting aside a portion of your income regularly and investing it in a savings account, retirement account, or other investment vehicles.

- Investing: Investing involves putting your money into assets that have the potential to generate returns, such as stocks, bonds, or real estate. It’s essential to have a well-diversified investment portfolio to minimize risk and maximize returns.

- Debt Management: Managing debt is critical for maintaining good credit and avoiding financial difficulties. It involves paying off high-interest debt, such as credit card balances, and consolidating debt into lower-interest loans or credit cards.

- Retirement Planning: Retirement planning involves setting aside funds for your post-work life, such as contributing to a 401(k) or IRA account.

- Insurance: Insurance provides financial protection against unexpected events, such as illness, injury, or death. It’s essential to have adequate insurance coverage, including health, life, and disability insurance.

Why is Personal Finance Important?

Effective personal finance is crucial for achieving financial stability, security, and independence. Here are some reasons why personal finance is important:

- Financial Independence: Personal finance helps you achieve financial independence, which means having the ability to make choices about how you want to live your life without being constrained by financial limitations.

- Reduced Stress: Managing your finances effectively can reduce stress and anxiety, as you’ll have a clear understanding of your financial situation and be better equipped to handle unexpected expenses.

- Improved Credit Score: Good personal finance habits, such as paying bills on time and keeping debt levels low, can help improve your credit score, which can lead to better loan terms and lower interest rates.

- Increased Wealth: Personal finance helps you build wealth over time, which can provide a sense of security and freedom.

- Better Retirement: Effective personal finance can help you achieve your retirement goals, such as traveling, pursuing hobbies, or simply enjoying time with loved ones.

Tips for Managing Your Finances Effectively

Here are some tips for managing your finances effectively:

- Create a Budget: Start by tracking your income and expenses to create a budget that works for you.

- Set Financial Goals: Identify your short-term and long-term financial goals, such as saving for a down payment on a house or retirement.

- Prioritize Needs over Wants: Be honest about what you need versus what you want, and prioritize essential expenses, such as rent/mortgage, utilities, and food, over discretionary expenses, such as dining out or entertainment.

- Save and Invest: Make saving and investing a priority, and take advantage of tax-advantaged accounts, such as 401(k) or IRA accounts.

- Manage Debt: Pay off high-interest debt, such as credit card balances, and consolidate debt into lower-interest loans or credit cards.

- Monitor and Adjust: Regularly review your budget and financial progress, and make adjustments as needed to stay on track.

Common Personal Finance Mistakes to Avoid

Here are some common personal finance mistakes to avoid:

- Not Creating a Budget: Failing to create a budget can lead to financial chaos and make it difficult to achieve your financial goals.

- Not Saving Enough: Not saving enough can leave you vulnerable to financial shocks, such as job loss or unexpected expenses.

- Accumulating High-Interest Debt: Accumulating high-interest debt, such as credit card balances, can lead to financial difficulties and stress.

- Not Investing: Failing to invest can mean missing out on potential returns and wealth-building opportunities.

- Not Reviewing and Adjusting: Not regularly reviewing and adjusting your budget and financial plan can lead to stagnation and missed opportunities.

Frequently Asked Questions (FAQs)

- What is the 50/30/20 rule?

The 50/30/20 rule is a budgeting guideline that suggests allocating 50% of your income towards essential expenses, 30% towards discretionary expenses, and 20% towards saving and debt repayment. - How do I create a budget?

To create a budget, start by tracking your income and expenses, then categorize your expenses into essential, discretionary, and debt repayment categories. Allocate funds accordingly, and review and adjust your budget regularly. - What is the difference between a savings account and an investment account?

A savings account is a liquid account that provides easy access to your money, while an investment account is a longer-term account that invests your money in assets, such as stocks or bonds, to generate returns. - How do I pay off debt?

To pay off debt, start by prioritizing high-interest debt, such as credit card balances, and focus on paying more than the minimum payment each month. Consider consolidating debt into lower-interest loans or credit cards. - What is a credit score, and how do I improve it?

A credit score is a three-digit number that reflects your creditworthiness. To improve your credit score, pay bills on time, keep debt levels low, and avoid applying for too much credit.

Conclusion

Personal finance is a critical aspect of achieving financial stability, security, and independence. By understanding the key aspects of personal finance, creating a budget, saving and investing, managing debt, and planning for the future, you can set yourself up for long-term financial success. Remember to avoid common personal finance mistakes, such as not creating a budget or accumulating high-interest debt, and stay informed about personal finance topics to continue improving your financial literacy. By taking control of your finances, you can achieve your financial goals, reduce stress and anxiety, and enjoy a more secure and fulfilling life.

Closure

Thus, we hope this article has provided valuable insights into The Importance of Personal Finance: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!