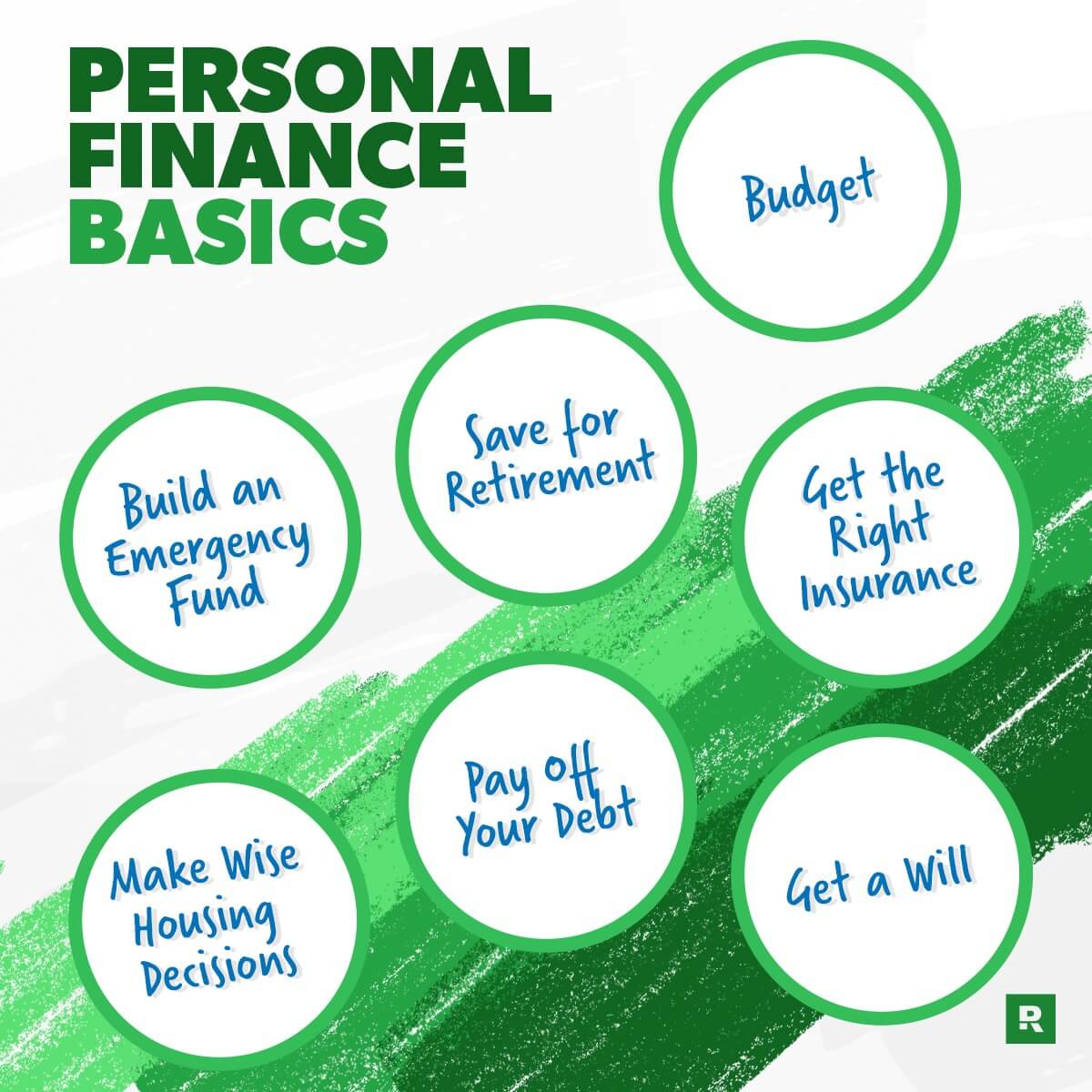

Managing one’s finances effectively is a crucial aspect of achieving financial stability and security. Personal finance encompasses a wide range of topics, including budgeting, saving, investing, and managing debt. In this article, we will delve into the basics of personal finance, providing you with a comprehensive guide to help you take control of your financial situation.

Understanding Your Financial Goals

Before diving into the nitty-gritty of personal finance, it’s essential to understand your financial goals. What do you want to achieve? Are you looking to save for a down payment on a house, pay off debt, or build an emergency fund? Identifying your financial goals will help you create a roadmap for achieving them.

Budgeting: The Foundation of Personal Finance

Budgeting is the process of tracking your income and expenses to ensure you’re making the most of your money. A budget helps you prioritize your spending, make smart financial decisions, and achieve your financial goals. To create a budget, follow these steps:

- Track your income: Start by calculating how much money you have coming in each month.

- Track your expenses: Write down every single transaction you make, including small purchases like coffee or snacks.

- Categorize your expenses: Divide your expenses into categories, such as housing, transportation, food, and entertainment.

- Set financial goals: Based on your income and expenses, set specific financial goals, such as saving for a emergency fund or paying off debt.

- Adjust your spending: Make adjustments to your spending habits to ensure you’re allocating your money effectively.

Saving and Emergency Funds

Saving is an essential aspect of personal finance. It provides a cushion in case of unexpected expenses or financial setbacks. Aim to save at least 10% to 20% of your income each month. An emergency fund is a type of savings account that covers 3-6 months of living expenses in case of an emergency, such as job loss or medical bills.

Investing: Growing Your Wealth

Investing is a great way to grow your wealth over time. There are various investment options available, including:

- Stocks: Stocks represent ownership in companies and offer potential for long-term growth.

- Bonds: Bonds are debt securities that provide regular income and relatively low risk.

- Mutual Funds: Mutual funds are diversified investment portfolios that pool money from multiple investors.

- Retirement Accounts: Retirement accounts, such as 401(k) or IRA, offer tax benefits and help you save for retirement.

Managing Debt

Debt can be a significant obstacle to achieving financial stability. To manage debt effectively:

- Create a debt repayment plan: Prioritize your debts, focusing on high-interest debts first.

- Pay more than the minimum: Paying more than the minimum payment can help you pay off debt faster.

- Consider debt consolidation: Consolidating debt into a single loan with a lower interest rate can simplify your payments.

Credit Scores and Reports

Your credit score is a three-digit number that represents your creditworthiness. A good credit score can help you qualify for loans and credit cards with favorable interest rates. To maintain a healthy credit score:

- Make on-time payments: Pay your bills on time to avoid late fees and negative credit reporting.

- Keep credit utilization low: Keep your credit card balances low compared to your credit limits.

- Monitor your credit report: Check your credit report regularly to ensure it’s accurate and up-to-date.

Insurance and Risk Management

Insurance helps protect you against unexpected events, such as accidents or illnesses. Common types of insurance include:

- Health Insurance: Health insurance covers medical expenses and provides financial protection in case of illness or injury.

- Life Insurance: Life insurance provides a death benefit to your beneficiaries in case of your passing.

- Disability Insurance: Disability insurance replaces a portion of your income if you become unable to work due to illness or injury.

Frequently Asked Questions (FAQs)

- What is the 50/30/20 rule?

The 50/30/20 rule is a budgeting guideline that allocates 50% of your income towards necessary expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. - How do I create a budget?

To create a budget, track your income and expenses, categorize your expenses, set financial goals, and adjust your spending habits. - What is the difference between a savings account and an emergency fund?

A savings account is a general-purpose savings account, while an emergency fund is a specific type of savings account designed to cover 3-6 months of living expenses in case of an emergency. - How do I invest in the stock market?

To invest in the stock market, open a brokerage account, research and select stocks or investment funds, and set a budget for your investments. - What is a credit score, and how is it calculated?

A credit score is a three-digit number that represents your creditworthiness, calculated based on your payment history, credit utilization, credit age, and other factors.

Conclusion

Personal finance is a complex and multifaceted topic, but by understanding the basics, you can take control of your financial situation and achieve your goals. Remember to:

- Create a budget and track your expenses

- Save for emergencies and long-term goals

- Invest in a diversified portfolio

- Manage debt effectively

- Maintain a healthy credit score

- Protect yourself with insurance and risk management strategies

By following these principles and staying informed, you’ll be well on your way to achieving financial stability and security. Start your journey today, and take the first step towards a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into The Basics of Personal Finance: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!