In the world of personal finance, Quicken has long been a household name. For decades, it has been the go-to software for managing finances, tracking expenses, and creating budgets. However, with the rise of digital banking and fintech innovations, several alternatives have emerged, offering similar, if not better, features and functionalities. In this article, we will explore the best alternatives to Quicken for personal finance, their features, and benefits.

Why Look for Alternatives to Quicken?

Before we dive into the alternatives, it’s essential to understand why you might want to consider them in the first place. While Quicken is still a popular choice, it has some limitations. For instance:

- Cost: Quicken can be expensive, especially for individuals who only need basic features.

- Complexity: Quicken’s interface can be overwhelming, especially for those who are new to personal finance software.

- Limited mobile support: Quicken’s mobile app is not as robust as some of its competitors.

- No free version: Quicken does not offer a free version, which can be a deterrent for those who want to try before they buy.

Top Alternatives to Quicken

- Mint: Mint is a free personal finance software that offers a wide range of features, including budgeting, expense tracking, and bill tracking. It also provides investment tracking and alerts for unusual account activity.

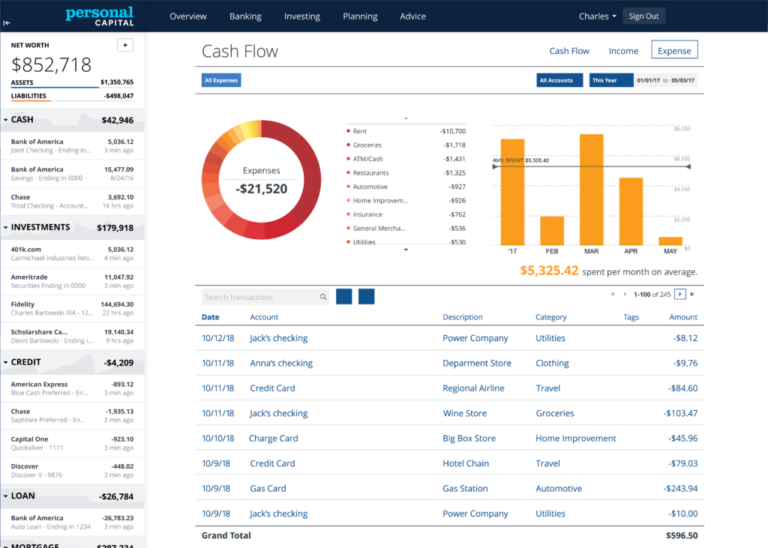

- Personal Capital: Personal Capital is a free financial management software that offers investment tracking, budgeting, and financial planning tools. It also provides a comprehensive financial dashboard and alerts for unusual account activity.

- You Need a Budget (YNAB): YNAB is a popular budgeting software that offers a unique approach to managing finances. It helps users prioritize their expenses and create a budget that works for them.

- GnuCash: GnuCash is a free, open-source personal finance software that offers a wide range of features, including budgeting, expense tracking, and investment tracking.

- TurboTax: TurboTax is a well-known tax preparation software that also offers personal finance tools, including budgeting and expense tracking.

- Simplifi: Simplifi is a free personal finance software that offers a simple and intuitive interface for tracking expenses, creating budgets, and monitoring investments.

- Wally: Wally is a free personal finance software that offers a wide range of features, including budgeting, expense tracking, and investment tracking.

Features to Consider

When choosing an alternative to Quicken, there are several features to consider:

- Budgeting: Look for software that offers robust budgeting tools, including the ability to create custom budgets and track expenses.

- Expense tracking: Consider software that offers automatic expense tracking, including the ability to categorize and tag expenses.

- Investment tracking: If you have investments, look for software that offers investment tracking, including the ability to monitor portfolio performance and receive alerts for unusual activity.

- Mobile support: Consider software that offers a robust mobile app, including the ability to track expenses and monitor accounts on-the-go.

- Security: Look for software that offers robust security features, including encryption and two-factor authentication.

- Customer support: Consider software that offers comprehensive customer support, including online resources and phone support.

Benefits of Using Alternatives to Quicken

Using alternatives to Quicken can offer several benefits, including:

- Cost savings: Many alternatives to Quicken are free or low-cost, which can save you money in the long run.

- Simplified interface: Many alternatives to Quicken offer a more streamlined and intuitive interface, making it easier to manage your finances.

- Improved mobile support: Many alternatives to Quicken offer robust mobile apps, making it easier to track expenses and monitor accounts on-the-go.

- Increased security: Many alternatives to Quicken offer robust security features, including encryption and two-factor authentication.

- Comprehensive features: Many alternatives to Quicken offer a wide range of features, including budgeting, expense tracking, and investment tracking.

Frequently Asked Questions (FAQ)

- Is Quicken still a good option for personal finance?

Yes, Quicken is still a good option for personal finance, but it may not be the best choice for everyone. Consider alternatives that offer similar features and functionalities at a lower cost. - What is the best alternative to Quicken?

The best alternative to Quicken depends on your specific needs and preferences. Consider software that offers robust budgeting tools, expense tracking, and investment tracking, as well as a user-friendly interface and comprehensive customer support. - Is Mint a good alternative to Quicken?

Yes, Mint is a good alternative to Quicken. It offers a wide range of features, including budgeting, expense tracking, and investment tracking, as well as a user-friendly interface and comprehensive customer support. - Can I use multiple personal finance software at the same time?

Yes, you can use multiple personal finance software at the same time. Consider using one software for budgeting and expense tracking, and another for investment tracking and financial planning. - How do I choose the best personal finance software for my needs?

Consider your specific needs and preferences, including budgeting, expense tracking, and investment tracking. Research different software options and read reviews to find the best fit for you.

Conclusion

In conclusion, while Quicken is still a popular choice for personal finance, there are several alternatives that offer similar features and functionalities at a lower cost. Consider software that offers robust budgeting tools, expense tracking, and investment tracking, as well as a user-friendly interface and comprehensive customer support. By exploring these alternatives, you can find the best fit for your personal finance needs and take control of your financial future. Remember to research and compare different software options, and don’t be afraid to try before you buy. With the right personal finance software, you can achieve financial stability and success.

Closure

Thus, we hope this article has provided valuable insights into Alternatives to Quicken for Personal Finance: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!