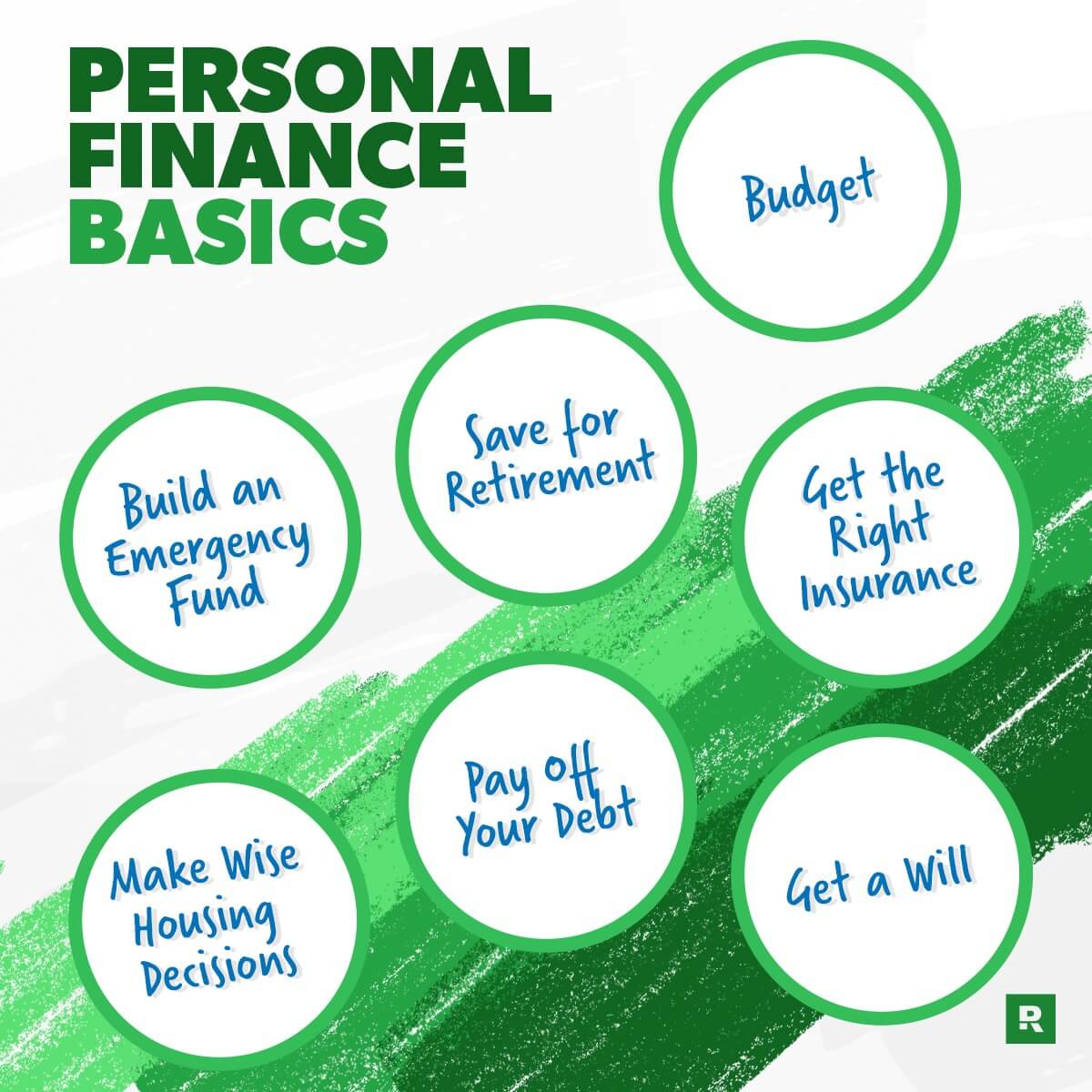

Personal finance is a crucial aspect of our lives, and it’s essential to understand the basics to manage our money effectively. With the rising costs of living, increasing debt, and uncertainty about the future, it’s more important than ever to take control of our financial lives. In this article, we’ll cover the fundamental principles of personal finance, including budgeting, saving, investing, and managing debt. We’ll also provide answers to frequently asked questions and offer tips on how to improve your financial well-being.

Understanding Your Financial Situation

Before you can start managing your finances, you need to understand your current financial situation. This includes tracking your income, expenses, assets, and debts. Start by gathering all your financial documents, including pay stubs, bank statements, credit card statements, and loan documents. Make a list of all your income sources, including your salary, investments, and any side hustles. Next, track your expenses by categorizing them into needs (housing, food, transportation, and utilities) and wants (entertainment, hobbies, and travel).

Creating a Budget

A budget is a plan for how you want to allocate your money towards different expenses. It’s essential to create a budget that works for you, not against you. Start by setting financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund. Then, assign a percentage of your income to each category of expenses. A general rule of thumb is to allocate 50% of your income towards needs, 30% towards wants, and 20% towards saving and debt repayment.

Saving and Emergency Funds

Saving is an essential part of personal finance. It provides a cushion in case of unexpected expenses or job loss. Aim to save at least 10% to 20% of your income each month. You can start by setting up an automatic transfer from your checking account to your savings account. Consider opening a high-yield savings account, which can earn you a higher interest rate than a traditional savings account.

An emergency fund is a separate savings account that’s specifically designed to cover unexpected expenses, such as car repairs or medical bills. Aim to save three to six months’ worth of living expenses in your emergency fund. This will provide you with a financial safety net in case of unexpected events.

Investing

Investing is a great way to grow your wealth over time. However, it’s essential to understand the risks and rewards associated with different types of investments. Start by learning about different asset classes, such as stocks, bonds, and real estate. Consider consulting with a financial advisor or using a robo-advisor to help you get started.

Managing Debt

Debt can be a significant obstacle to achieving financial freedom. Start by making a list of all your debts, including credit cards, loans, and mortgages. Then, prioritize your debts by focusing on the ones with the highest interest rates first. Consider consolidating your debt into a single loan with a lower interest rate. Make sure to pay more than the minimum payment each month to pay off your debt faster.

Credit Score

Your credit score is a three-digit number that represents your creditworthiness. It’s essential to maintain a good credit score to qualify for loans and credit cards with favorable interest rates. You can check your credit score for free on websites such as Credit Karma or Credit Sesame. To improve your credit score, make sure to pay your bills on time, keep your credit utilization ratio low, and avoid applying for too many credit cards.

Frequently Asked Questions (FAQs)

- What’s the best way to create a budget?

The best way to create a budget is to start by tracking your income and expenses. Then, assign a percentage of your income to each category of expenses. Make sure to review and adjust your budget regularly to ensure it’s working for you. - How much should I save each month?

Aim to save at least 10% to 20% of your income each month. You can start by setting up an automatic transfer from your checking account to your savings account. - What’s the difference between a savings account and an emergency fund?

A savings account is a general savings account that can be used for any purpose. An emergency fund is a separate savings account that’s specifically designed to cover unexpected expenses, such as car repairs or medical bills. - How do I invest in the stock market?

Start by learning about different asset classes, such as stocks, bonds, and real estate. Consider consulting with a financial advisor or using a robo-advisor to help you get started. - What’s the best way to pay off debt?

Start by making a list of all your debts, including credit cards, loans, and mortgages. Then, prioritize your debts by focusing on the ones with the highest interest rates first. Consider consolidating your debt into a single loan with a lower interest rate.

Conclusion

Personal finance is a crucial aspect of our lives, and it’s essential to understand the basics to manage our money effectively. By creating a budget, saving, investing, and managing debt, you can take control of your financial life and achieve financial freedom. Remember to review and adjust your budget regularly, save at least 10% to 20% of your income each month, and prioritize your debts by focusing on the ones with the highest interest rates first. With patience, discipline, and the right knowledge, you can achieve your financial goals and live a more secure and prosperous life.

By following the principles outlined in this article, you’ll be well on your way to achieving financial stability and security. Remember to stay informed, stay disciplined, and always keep your long-term goals in mind. With the right mindset and the right tools, you can overcome any financial challenge and achieve financial success. So, start today, and take the first step towards a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into Introduction to Basic Personal Finance. We hope you find this article informative and beneficial. See you in our next article!