In today’s digital age, managing one’s personal finances has become easier than ever, thanks to the numerous mobile apps available. These apps have made it possible for individuals to track their expenses, create budgets, and set financial goals, all from the convenience of their smartphones. With so many options available, it can be overwhelming to choose the right app for your financial needs. In this article, we will explore some of the top personal finance apps, their features, and how they can help you take control of your finances.

1. Mint

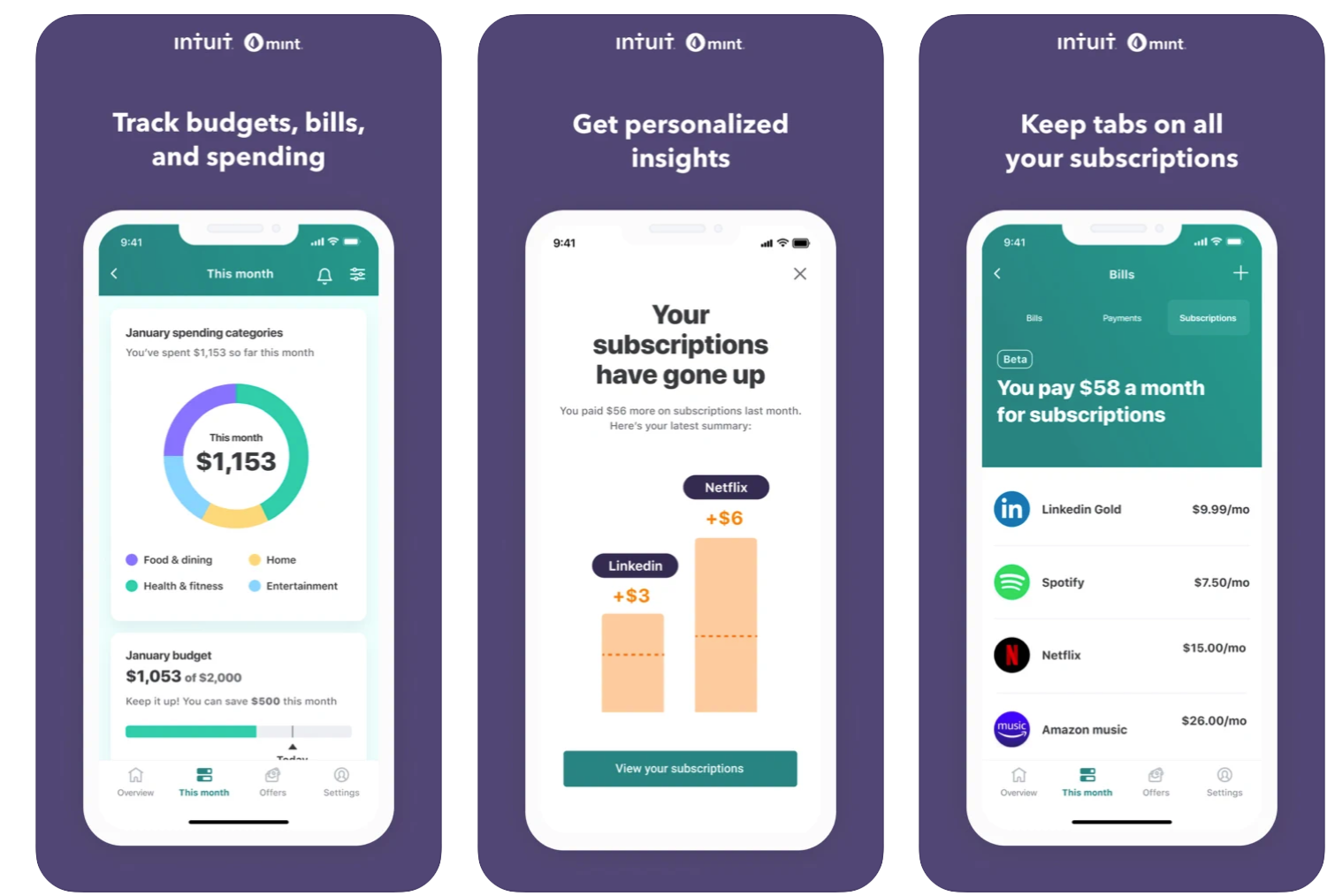

Mint is one of the most popular personal finance apps, and for good reason. It offers a wide range of features, including budgeting, bill tracking, and investment monitoring. Mint also provides users with a free credit score and report, making it an excellent tool for those looking to improve their credit. The app is user-friendly and allows users to set financial goals, such expenses, and receive alerts when they go over budget.

2. Personal Capital

Personal Capital is another highly-rated personal finance app that offers a comprehensive view of your financial situation. The app allows users to link their bank accounts, credit cards, and investments, providing a clear picture of their net worth. Personal Capital also offers investment tracking, retirement planning, and financial planning tools, making it an excellent choice for those looking to plan for the future.

3. You Need a Budget (YNAB)

YNAB is a budgeting app that helps users manage their finances by assigning jobs to every dollar they earn. The app is based on the principle that every dollar should be assigned a task, whether it’s saving, spending, or investing. YNAB offers a free trial, and then it’s $6.99 per month or $83.99 per year. The app is user-friendly and provides users with a clear picture of their finances, making it easier to make smart financial decisions.

4. PocketGuard

PocketGuard is a simple and easy-to-use app that helps users track their expenses and stay within their budget. The app links to your bank accounts and credit cards, providing a clear picture of your spending habits. PocketGuard also offers investment tracking and financial planning tools, making it an excellent choice for those looking to plan for the future.

5. Wally

Wally is a personal finance app that allows users to track their expenses, create budgets, and set financial goals. The app is user-friendly and provides users with a clear picture of their finances, making it easier to make smart financial decisions. Wally also offers investment tracking and financial planning tools, making it an excellent choice for those looking to plan for the future.

6. Spendee

Spendee is a budgeting app that helps users track their expenses and stay within their budget. The app links to your bank accounts and credit cards, providing a clear picture of your spending habits. Spendee also offers investment tracking and financial planning tools, making it an excellent choice for those looking to plan for the future.

7. Digit

Digit is a savings app that helps users save money by transferring small amounts of money from their checking account to their savings account. The app is user-friendly and provides users with a clear picture of their savings, making it easier to reach their financial goals.

8. Qapital

Qapital is a savings app that helps users save money by setting financial goals and transferring small amounts of money from their checking account to their savings account. The app is user-friendly and provides users with a clear picture of their savings, making it easier to reach their financial goals.

9. Clarity Money

Clarity Money is a personal finance app that helps users track their expenses, create budgets, and set financial goals. The app is user-friendly and provides users with a clear picture of their finances, making it easier to make smart financial decisions. Clarity Money also offers investment tracking and financial planning tools, making it an excellent choice for those looking to plan for the future.

10. Credit Karma

Credit Karma is a personal finance app that provides users with a free credit score and report. The app also offers financial planning tools, investment tracking, and tax preparation services, making it an excellent choice for those looking to improve their credit and plan for the future.

Features to Look for in a Personal Finance App

When choosing a personal finance app, there are several features to look for. These include:

- Budgeting: The ability to create a budget and track expenses

- Investment tracking: The ability to track investments and monitor their performance

- Financial planning: The ability to set financial goals and create a plan to achieve them

- Credit score and report: The ability to access a free credit score and report

- Security: The app should have robust security features to protect user data

- User-friendly interface: The app should be easy to use and navigate

Benefits of Using a Personal Finance App

Using a personal finance app can have numerous benefits, including:

- Improved financial management: Personal finance apps can help users track their expenses, create budgets, and set financial goals, making it easier to manage their finances.

- Increased savings: Personal finance apps can help users save money by transferring small amounts of money from their checking account to their savings account.

- Better credit: Personal finance apps can help users improve their credit by providing access to a free credit score and report.

- Reduced stress: Personal finance apps can help reduce financial stress by providing users with a clear picture of their finances and helping them make smart financial decisions.

Frequently Asked Questions (FAQs)

- What is the best personal finance app?

The best personal finance app depends on your individual needs and preferences. Some popular options include Mint, Personal Capital, and YNAB. - Are personal finance apps secure?

Yes, most personal finance apps have robust security features to protect user data. - Do personal finance apps cost money?

Some personal finance apps are free, while others charge a monthly or annual fee. - Can I use a personal finance app to track my investments?

Yes, many personal finance apps offer investment tracking and monitoring. - Can I use a personal finance app to improve my credit?

Yes, many personal finance apps provide access to a free credit score and report, and offer tools to help improve your credit.

Conclusion

Personal finance apps have made it easier than ever to manage your finances, track your expenses, and set financial goals. With so many options available, it’s essential to choose an app that meets your individual needs and preferences. By considering the features and benefits of each app, you can find the perfect tool to help you take control of your finances and achieve financial stability. Whether you’re looking to improve your credit, save money, or invest in your future, there’s a personal finance app out there for you. So why not start exploring today and take the first step towards a brighter financial future?

Closure

Thus, we hope this article has provided valuable insights into Managing Your Finances with Ease: Top Personal Finance Apps. We appreciate your attention to our article. See you in our next article!