Personal finance is a crucial aspect of our lives, and managing it effectively can make a significant difference in our overall well-being. It involves making informed decisions about how to allocate our resources, such as income, expenses, savings, and investments, to achieve our financial goals. In this article, we will delve into the basics of personal finance, exploring the key concepts, principles, and strategies that can help individuals manage their finances effectively.

Understanding Your Financial Situation

The first step in managing your personal finances is to understand your current financial situation. This involves tracking your income, expenses, assets, and liabilities. Start by gathering all your financial documents, including pay stubs, bank statements, credit card statements, and loan documents. Next, create a budget that outlines your income and expenses. This will help you identify areas where you can cut back on unnecessary expenses and allocate your resources more efficiently.

Setting Financial Goals

Setting financial goals is an essential part of personal finance. It helps you focus on what you want to achieve and creates a roadmap for getting there. Short-term goals may include paying off debt, building an emergency fund, or saving for a specific expense, such as a down payment on a house. Long-term goals may include retirement planning, saving for a child’s education, or investing in a business. When setting financial goals, make sure they are specific, measurable, achievable, relevant, and time-bound (SMART).

Managing Expenses

Managing expenses is a critical aspect of personal finance. It involves tracking your spending, identifying areas where you can cut back, and making adjustments to stay within your means. Start by categorizing your expenses into needs (housing, food, transportation, and utilities) and wants (entertainment, hobbies, and travel). Next, prioritize your needs over your wants and allocate your resources accordingly. Consider using the 50/30/20 rule, where 50% of your income goes towards needs, 30% towards wants, and 20% towards saving and debt repayment.

Saving and Investing

Saving and investing are essential components of personal finance. Saving involves setting aside a portion of your income for short-term and long-term goals, while investing involves using your savings to grow your wealth over time. Consider opening a savings account, such as a high-yield savings account or a certificate of deposit (CD), to earn interest on your savings. For investing, consider a diversified portfolio of stocks, bonds, and other assets, such as a 401(k) or an individual retirement account (IRA).

Managing Debt

Managing debt is a critical aspect of personal finance. It involves understanding the different types of debt, such as credit card debt, student loans, and mortgages, and developing strategies to pay them off. Start by prioritizing your debts, focusing on high-interest debts first. Consider consolidating your debts into a single loan with a lower interest rate and a longer repayment period. Make timely payments, and avoid accumulating new debt while paying off existing debts.

Building Credit

Building credit is an essential part of personal finance. It involves establishing a positive credit history, which can help you qualify for loans, credit cards, and other financial products. Start by checking your credit report, which is a record of your credit history. Dispute any errors or inaccuracies, and work on improving your credit score by making timely payments, keeping credit utilization low, and avoiding new credit inquiries.

Insurance and Risk Management

Insurance and risk management are critical components of personal finance. They involve protecting yourself and your assets from unexpected events, such as accidents, illnesses, or natural disasters. Consider purchasing insurance products, such as health insurance, life insurance, and disability insurance, to mitigate risks. Additionally, consider building an emergency fund to cover unexpected expenses and avoid going into debt.

Retirement Planning

Retirement planning is a critical aspect of personal finance. It involves saving and investing for your golden years, when you will no longer be working. Start by contributing to a retirement account, such as a 401(k) or an IRA, and take advantage of any employer matching contributions. Consider working with a financial advisor to develop a retirement plan that meets your needs and goals.

Frequently Asked Questions (FAQs)

- What is the best way to manage my expenses?

The best way to manage your expenses is to track your spending, categorize your expenses, and prioritize your needs over your wants. - How much should I save for retirement?

The amount you should save for retirement depends on your age, income, and goals. A general rule of thumb is to save at least 10% to 15% of your income towards retirement. - What is the difference between a credit score and a credit report?

A credit score is a three-digit number that represents your creditworthiness, while a credit report is a record of your credit history. - How can I improve my credit score?

You can improve your credit score by making timely payments, keeping credit utilization low, and avoiding new credit inquiries. - What is the best way to invest my money?

The best way to invest your money depends on your risk tolerance, goals, and time horizon. Consider working with a financial advisor to develop an investment plan that meets your needs.

Conclusion

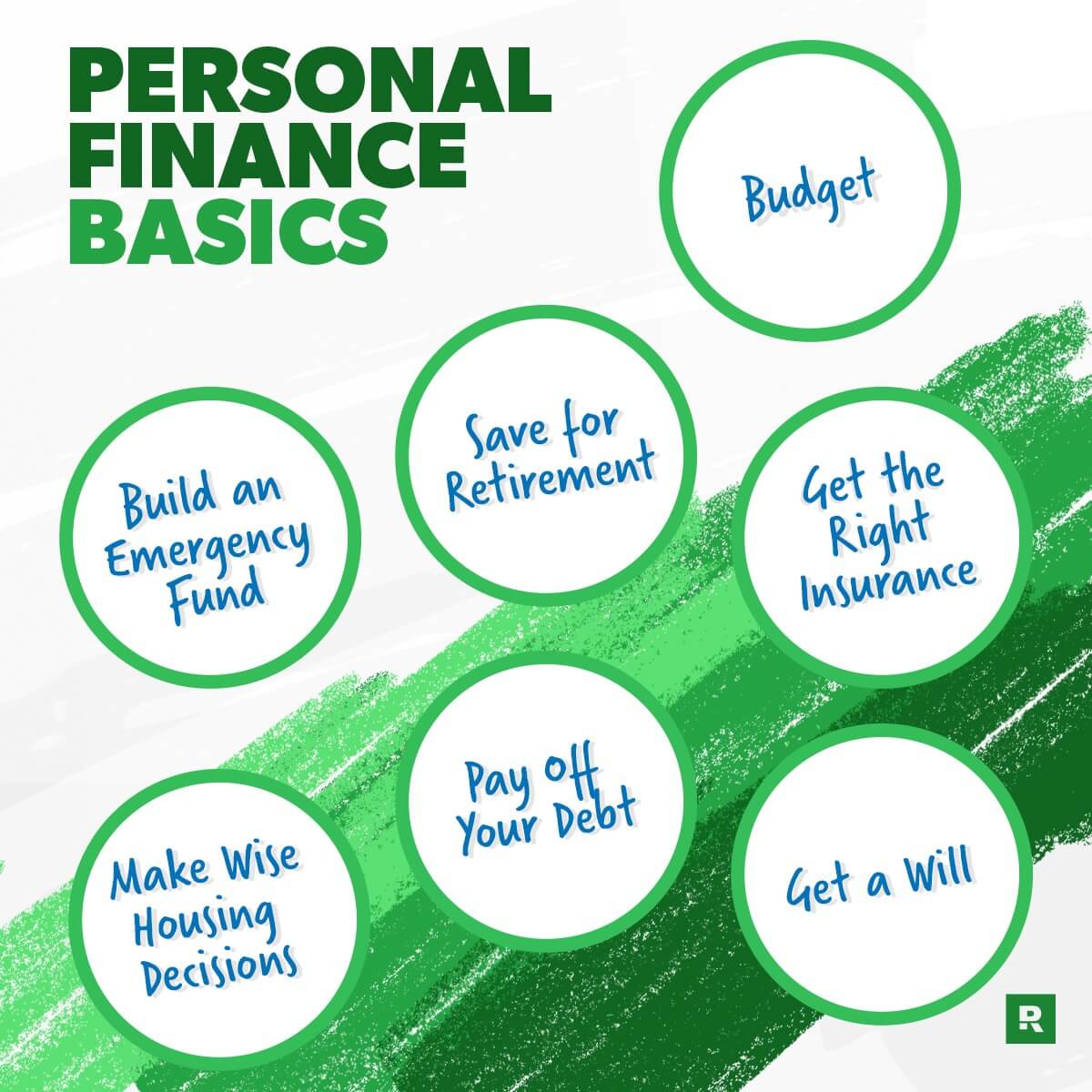

Personal finance is a complex and multifaceted topic, but by understanding the basics, you can take control of your financial situation and achieve your goals. Remember to track your income and expenses, set financial goals, manage your expenses, save and invest, manage debt, build credit, and plan for retirement. By following these principles and strategies, you can create a brighter financial future for yourself and your loved ones. Always keep in mind that personal finance is a journey, and it’s essential to be patient, disciplined, and informed to achieve long-term success.

Closure

Thus, we hope this article has provided valuable insights into The Basics of Personal Finance: A Comprehensive Guide. We appreciate your attention to our article. See you in our next article!